How confident are you in your association’s ability to navigate the current crisis and, more importantly, what does the crisis mean for your association? Without a clear outline of potential scenarios and responses, your organization is missing a critical tool that can inform and promote dialogue, guide decision-making, and compel action. In a recent webinar focused on financial analysis and scenario planning, we outlined scenarios representing how global disruption might impact a typical association.

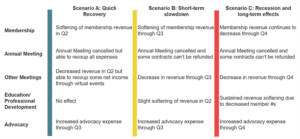

Since uncertainty remains prevalent, it is important to establish scenarios that represent a wide range of potential conditions. Below are the three examples to guide your approach:

- A quick recovery

- A short-term slowdown

- A Recession and long-term effects

By building a financial model equipped to react to any outcome, you set a strong foundation for not only navigating crisis but strengthening your organization and the trust your members and stakeholders have in it.

Guiding Principles

While developing your model, here are the guiding principles to keep in mind:

- Allocate programmatic revenue and expense — What will be the financial impact of contractions or cancellations to programs? Ensure that you can accurately allocate expenses and revenue.

- Identify “trigger” points — Outline how scenarios related to COVID-19 will impact your revenue streams and create “trigger” points that will necessitate expense reductions.

- Set a target — Decide on a financial goal or target. For example, is your goal to break-even? Are you planning to tap your reserves?

- Prioritize action steps — Identify a set of expense reduction strategies that you can layer onto your model to arrive at a bottom line that will be acceptable for the new circumstances of this year.

Building Your Model

While keeping these overarching ideas in mind, you are ready to begin the necessary steps to complete your model. Be aware that each step requires educated guesses; there is no perfect science to forming assumptions and building scenarios. Ask yourself: How can you tap into industry resources, your colleagues or members to inform each step?

Step 1: Translate scenarios into assumptions

Apply the spectrum of scenarios to your association by breaking down your product lines and how they would be impacted under each, from best to worst case. This should be a living model — the idea is to start broad, but as the situation unfolds and you get more data on how your revenue streams can be impacted, make updates to your projections.

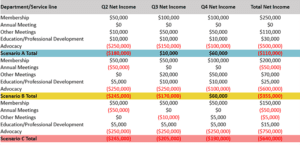

Step 2: Outline net income effects

This is where your assumptions get translated into numbers. Different organizations will tolerate these scenarios in different ways, so remember the targets you set. If you are hoping to breakeven, you will make different choices than if you are planning to tap into your reserves.

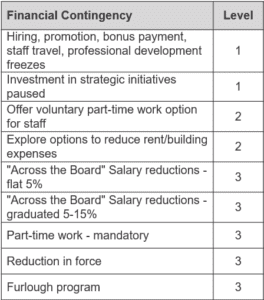

Step 3: Identify financial contingencies

By the time you reach this step, you should be able to begin to identify a cost reduction strategy. Level one should include minor measures to reduce expenses, while the higher levels will represent more disruptive measures. Once you outline each strategy and potential expense savings, you are ready for the final step.

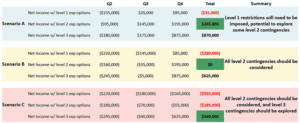

Step 4: Align scenarios with financial contingencies

This last step is where each scenario should be mapped out based on the impact of each level of expense reduction. Keep the ultimate goal in mind. How can you cut costs without cutting into revenue potential? Which of the scenario outcomes can you tolerate?

As a living model, these scenarios should not remain static. You should update them as you navigate any crisis and learn more to narrow your range of options. It is always better to start with broad assumptions and then narrow in on them, evaluating your tolerance for risk along the way. Ideally, scenario planning is a useful tool not only in times of uncertainty, but also when planning for changes within your organization.

Need help with financial analysis and scenario planning? Contact Us.

Tag(s):

Business Models

Strategic Planning

7 min read

| January 15, 2026

Unlocking Opportunities: How “Uncomfortable” Can You Get with Strategy?

Read More

Strategic Planning

3 min read

| December 19, 2025

The Forces Reshaping Associations

Read More

Business Models

5 min read

| November 12, 2025