October 24, 2025

What Your Association Should Expect from Research Partners

Written by: Patrick Glaser, MA, MPA

In the early 2000s, associations began shifting toward data-driven decision-making. With faster computers and growing volumes of information, relying on intuition alone was no longer acceptable for guiding business strategy. Around the same time, data collection tools such as SurveyMonkey became more affordable, lowering the barrier to entry so that any consultant or association staff member could suddenly step into the role of marketing researcher.

While the trend toward leveraging data for decision-making resulted in many positive outcomes, it had negative consequences as well: the market became flush with low-quality research. Marketing research became commoditized by vendors who lacked the skill and expertise to conduct research or develop real insights, leaving many associations with a bad taste in their mouths. This trend continues today, but poor research is easy to spot, and associations can take simple steps to protect themselves when choosing the wrong option. Here are a few tips.

Strategic Analysis, Not Data Dumps

When selecting a research partner, ask to see an example of their work and be sure to speak with a reference. One of the key things you’ll want to investigate — a dead giveaway of whether they’re qualified to support your work — is their ability to draw insights from the data.

Skilled research consultants understand that raw data alone holds little value; it’s the interpretation and synthesis that transform numbers into strategic insights. For example, the ability to spend time with the data and perform the right analysis to understand not just that a key segment of membership is dissatisfied, but why they are dissatisfied, how their needs are different from other segments, why the association isn’t currently meeting their expectations, and what specific interventions will result in change. Professional researchers don’t simply present what the data shows; they explain what it means for your association’s specific objectives.

When you review an example deliverable from your consultant, expect them to weave a cohesive narrative that connects disparate data points, identifies patterns, and offers an informed hypothesis about underlying trends.

After all, this is why you are hiring them, and their ability to get beyond a simple data dump should be evident in their work. They should anticipate your questions and provide analysis that directly addresses your strategic challenges. When research truly serves its purpose, you’ll find yourself saying, “This helps us understand exactly what we need to do next,” rather than, “What are we supposed to do with all these numbers?”

One hint: the difference becomes apparent in how findings are presented. Professional analysis contextualizes results within your industry landscape, draws connections between different survey sections or data sources, and provides frameworks for decision-making. Basic reporting, by contrast, often reads like a description of charts with minimal interpretation or strategic guidance.

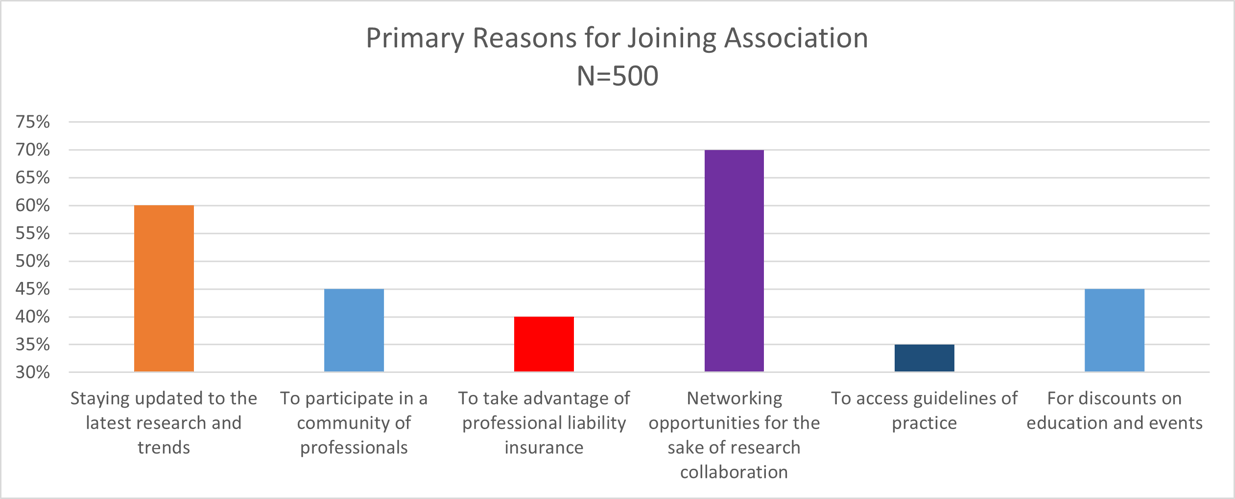

Think back to your last survey report. Was it a mere “data dump?”:

.png?width=900&height=504&name=Member%20Satisfaction%20(1000%20x%20560%20px).png)

Demand better analysis and insight from your research vendor:

%20(1).png?width=900&height=504&name=Member%20Satisfaction%20(1000%20x%20560%20px)%20(1).png)

Thoughtful Data Visualization and Presentation

An additional sign that you are dealing with a highly skilled research consultant is their ability to present data appropriately. Professional research partners recognize that how data is presented significantly impacts its usability and persuasiveness. Every visual element — from chart selection to axis scaling — should be deliberately chosen to facilitate quick comprehension and meaningful comparisons.

This is particularly important for research deliverables, which can involve many charts and sections. A report that is not optimized can lead, at best, to overwhelm and, at worst, to misinterpretation of the data.

Quality visualizations guide the reader’s eye to key insights through strategic ordering of data points, appropriate chart types for the information being conveyed, and clear, descriptive titles that communicate the main finding. The visual design should be polished and consistent, reflecting the professionalism of your association.

In the example below, notice how the items included in the chart follow no particular order, making it difficult to easily and quickly understand their priority ranking. Worse yet, the axis scale ranges only from 30% to 75% which creates distortion leading to the perception that differences among the reasons to join are much greater than in reality (i.e., at 60%, the desire to stay updated to research and trends falsely appears to be twice as important as participating in a community of professionals (45%)).

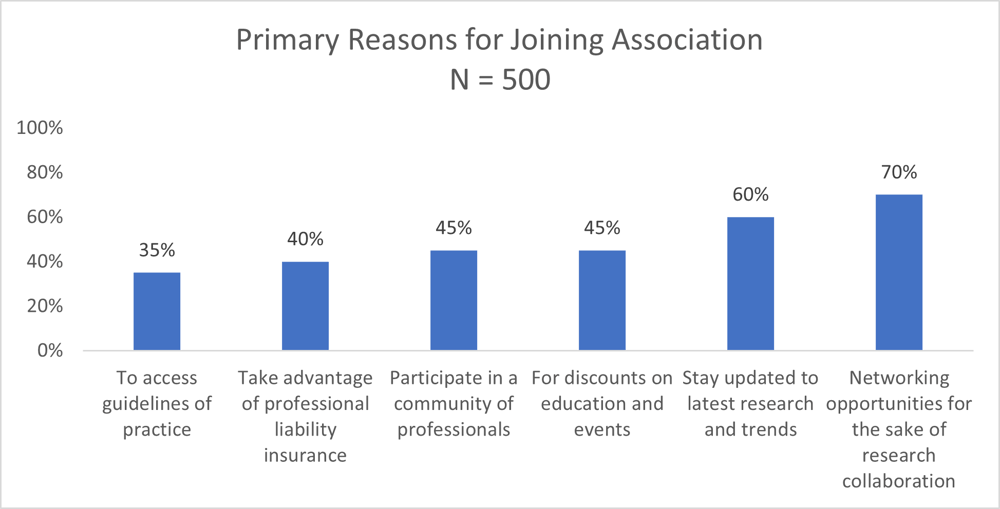

In contrast, the presentation of data below features a rank ordering of chart items, an appropriate 0%-100%-point axis, and a single-color pattern to reduce the overall noise of the chart.

Beware of research deliverables that appear to be direct exports from software platforms without customization. These often feature default formatting, poorly scaled axes, arbitrary data ordering, and generic titles that obscure rather than illuminate key findings. Your research investment deserves the additional effort required to transform raw output into compelling, accessible insights.

Methodological Rigor and Expertise

Perhaps most critically, professional research partners bring deep methodological expertise that ensures your investment yields reliable, valid results. This expertise manifests in countless decisions throughout the research process — from survey design to sampling strategies to analysis approaches.

Quality researchers understand the various sources of error that can compromise research reliability. They proactively design studies that minimize these risks while balancing practical constraints such as budget and timeline.

In survey research specifically, this expertise becomes evident in questionnaire construction. Professional researchers navigate hundreds of established best practices—avoiding double-barreled questions, carefully crafting response scales, optimizing question flow to minimize bias, managing survey length to maintain engagement, and selecting language that conveys precise meaning to your specific audience. While they consider each of these design elements, they must also create questions that generate useful and usable information.

Example of Poor vs. Strong Survey Design

Poorly written question:

“How satisfied are you with your membership benefits and networking opportunities?”

Why it’s problematic: This is a double-barreled question — it asks about two things at once (benefits and networking). A respondent might feel differently about each, but the question forces one answer.

Improved version:

“How satisfied are you with your membership benefits?”

“How satisfied are you with the networking opportunities your membership provides?”

Why it’s better: Each question isolates one concept, uses clear language, and makes responses easier to interpret without bias.

The methodological foundation of your research directly impacts the confidence you can place in your findings and the success of strategies built upon those insights. Unfortunately, this element is harder to observe by reviewing a research deliverable, but it is essential to the validity of your data. To make sure you have a quality research partner, ask them questions about their expertise in survey design, what considerations they make in designing survey questionnaires, and how they ensure valid results. Your potential partner should be able to point to training in research and describe their philosophy and approach to research design.

The Cost of Compromising on Quality and Selecting the Right Partner

When associations partner with researchers who lack proper training or cut corners on methodology, the consequences extend far beyond disappointing deliverables. Poor research can mislead strategic planning, waste staff time as they interpret unclear findings, and ultimately erode confidence in research as a decision-making tool.

Your association deserves research partnerships that deliver genuine strategic value. Look for partners who demonstrate methodological expertise, present clear examples of insightful analysis from similar organizations, and show evidence of thoughtful data presentation practices.

Learn More

Are you interested in creating or revitalizing your association’s research and data strategy plan? Get in touchto learn more and find out how we can help deliver a research solution that works for you.

Tag(s):

Market Research

Strategic Planning

7 min read

| January 15, 2026

Unlocking Opportunities: How “Uncomfortable” Can You Get with Strategy?

Read More

Strategic Planning

3 min read

| December 19, 2025

Inside McKinley’s 2025 Annual Survey: The Forces Reshaping Associations

Read More

Business Models

5 min read

| November 12, 2025